Are you great at creating budgets and terrible at sticking to them? Do you find it a challenge to stay within the limits of each of your budget categories?

If you’re really serious about buckling down and finding a way to make your budget work, then you’re in the right place! This post will teach you everything you need to know about using the Cash Envelope System to stick to your budget and finally taking control of your finances!

The Cash Envelope System has helped thousands of individuals develop better money management habits and with the right nudge and resources, you can achieve all your financial goals too!

This post may contain some affiliate links. You can read our full disclosure for more info.

The Cash Envelope System is one of the simplest methods to budget your finances. It was made popular by Dave Ramsey, a US personal finance expert, best-selling author and radio host.

If you’re having issues with controlling your spending and you’re trying to find a solution to help you stick to your budget, the cash envelope system might be your best bet.

USA Today published a report on the budget of an average American household with a breakdown of how income is spent. According to the article, an average of $1 803 is spent on Apparel and Services, $2 913 on Entertainment and $959 on Miscellaneous! How does your budget compare to this?

Of course, when you’re on a mission to pay off debt and save more, such categories should be reduced so that your money could be put to better use (and you can finally achieve financial freedom!).

In addition to this, a report by the Bureau of Labor Statistics state that in 2015, households spent an average of $7 023 in food. This was further broken down into food at home and food away from home (takeout, eating at restaurants etc.).

The BLS report stated that 43% of this (about $3 008) was spent on food away from home! This was an eye opener for me since I’m a huge advocate for saving money through meal planning and cooking at home.

Is it that people don’t know how to prep and eat healthy on a budget? Or do they even have a budget at all? Are you one of these people? Are you ready to start budgeting and saving money?

Well let’s go back to making the cash envelope system work for you!

Table of Contents

What exactly is the Cash Envelope System?

The cash envelope system, as the name suggests, refers to tucking your cash away in various envelopes labeled according to your different budget categories.

Once you have created your budget plan and allocated how much money is to be spent on each category, you label your envelopes and add the set amount of cash to each.

The trick is that you cannot pay bills using cash from your ‘Food’ envelope or use cash from your ‘Transportation’ envelope to pay your student loan.

This system helps you to keep track of your spending and ensures that you don’t go over budget in any particular category.

Of course willpower plays a huge part in making the cash envelope system work! Let’s say it’s the second to last day of the month and you planned to have leftovers from your fridge. Instead, you get a craving for Chinese Takeout and head to your ‘Food’ envelope only to find your last $2.

Are you going to going to dig into another envelope or your savings JUST to get Chinese Takeout? Or are you going to stick to your plan and have your leftovers?

The way you handle scenarios like these is what makes the difference with your finances.

At the end of the month, how awesome is it to peek into your envelopes and see extra cash left?! The cash envelope system is such an amazing tool to help with overspending. This is because there’s something tangible in front of you and the lack of cash in an envelope will signal to your brain that it’s time to stop spending.

How does the Cash Envelope System Work?

The Cash Envelope system is super simple and easy to learn. The best part is that you can start immediately!

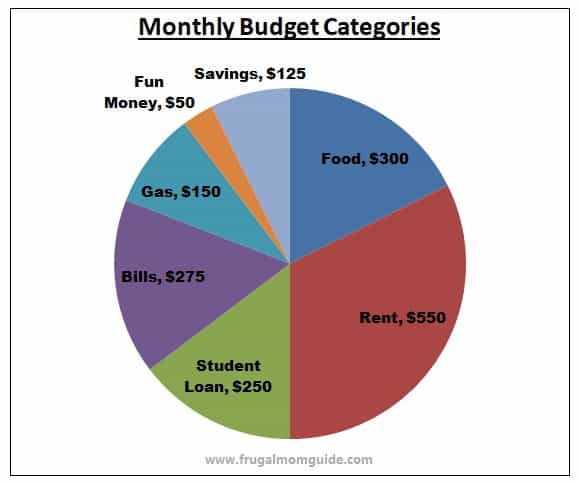

Suppose you work for $1700 per month. You’ll need to budget this $1700 according to your various monthly expenses. It might look something like this.

Each one of the above will have its own envelope with the exception of ‘Savings.’ This $125 can be deposited into your savings account as soon as you get paid.

So at the start of each month, $300 should be tucked into your ‘Food/Groceries’ envelope. Every time you go to the grocery store, or get takeout, money is used from this envelope ONLY.

Similarly, if you need to full gas in your car, this will be taken out of the $150 from your ‘Gas/Transportation’ envelope.

You can even choose to budget weekly by adding $75 to your ‘Food’ envelope per week and so on. On the other hand, if you get paid weekly, or fortnightly, just adapt this method to suit your schedule. Easy.

Truthfully, this is the fun and effortless part. Things start getting complicated when you go to the grocery store and you realize that you’ve picked up $300.50 worth of items. Remember, your budget is $300 and you can’t dip into any other envelopes.

Here is where your commitment comes into play. You’ll need to return something to the shelf so that you don’t go over budget.

Do not cheat and use your debit card and don’t cut yourself some slack. Savings aren’t made by cutting yourself some slack.

Also, stay under budget if you can. You’ll get to add all your leftover money to your savings account at the end of the month or you can even allocate the extra towards debt repayment!

How to Start a Cash Envelope System that Works (A Comprehensive Step by Step Instructional Guide)

1. Create a Budget

To determine your budget categories, you’ll need to create a proper budget plan by analysing your income and expenses. If you’re not sure how to get started, check out this guide which explains exactly How to Create a Budget Plan in 7 Simple Steps.

2. Allocate your Money

Your fixed expenses will be easy. However, you will have to decide how much money you can afford to spend on variable expenses such as ‘Food’ and ‘Fun Money.’

Other common categories include:

- Gas/Transportation Costs

- Health Care

- Rent/Mortgage

- Personal Care

- Loans

- Other Debt

3. Get your Envelopes Ready

This is the fun part. You can choose paper envelopes, DIY cloth envelopes or get cute ones like this one this from Amazon.

What you choose can be based completely on your style and personality. Choose something that you love so that you’d be excited and motivated throughout the process.

However, do not go overboard! Don’t forget that the point of this system is to save money and to take control of your finances!

If you are up for a simple DIY project, feel free to grab my amazing cash envelope template to get started! In a little bit, I’ll explain how to use this cash envelope template to make your very own cool, funky & fresh cash envelopes.

4. Tuck away your Cash into your Envelopes

Go ahead and add your cash to your envelopes and start rocking the cash envelope system right away!

Does the Cash Envelope System Work?

Absolutely! Yes, it does!

The Cash Envelope System works because there’s something about using tangible cash that makes it harder to spend. As you actually see your envelope running low, your brain acts accordingly and helps you with self-control when it comes to spending unnecessarily.

It also helps with overspending because there’s actually something in front of you telling you when to stop!

Advantages of the Cash Envelope System

1. Your budget becomes tangible

There’s just something about seeing your money right in your hands that makes it real and harder to spend. When you use cash to make purchases, you’re basically watching your dollars turn into cents.

It’s really easy to overspend when using plastic. However, using cash can keep you in check and help you save more!

2. No Charges and Fees

When using cash, there’s no need to worry about overdraft charges and late fees. There are no interest fees and no late fees involved. After a cash transaction is done, you don’t need to worry about paying back your credit card or any surprise charges to your debit card.

3. It Disciplines you

If you’ve been having problems with sticking to your budget and managing your money, the cash envelope system brings discipline in a way that no other budget can.

The restriction of having limited cash to spend from and specific envelopes to choose from might seem harsh and tough but may be just what you need to stop spending on unnecessary items.

4. Prevents Wasteful Spending

In relation to the point above, with discipline, you’re more likely to have better spending habits and stop spending on items that you do not need.

5. It is Convenient

There are some stores that do not accept credit cards and debit cards. However, it’s hardly unlikely that you’ll find a store that does not accept cash! Hence, you never have to worry about running to the ATM to withdraw cash as you’ll already have it available.

It’s also convenient in the case of an emergency. Although your cash envelopes are not for emergencies, they can always be used and replaced later. They can literally be a lifesaver if you’re in the middle of nowhere with no access to an ATM or Point of Sale machine.

6. You can take Advantage of Discounts

Many stores offer discounts when you pay with cash. Mom and Pop shops and even large retailers have to pay a fee for every Point of Sale transaction. Because of this, they may offer reductions on price tags for cash purchases. This in turn, will help you save even more!

7. You wouldn’t Miss a Payment

When you’re in control of your envelopes, your cash and your spending, you can be sure that your payments are all on time. Keep a calendar and notepad handy and write down all your bills and their due dates.

When you make your own payments, you do not need to worry about missed/late electronic transactions!

8. The Cash Envelope System Works!

As mentioned earlier, this system works. Cash envelopes make it harder to spend, easy to keep track of and effortlessly helps with discipline and self control.

Disadvantages of the Cash Envelope System

1. It’s Unsafe to Walk around with Cash

This is the biggest disadvantage of using the cash envelope system. Walking around with large wads of cash is not exactly safe. My suggestion is to keep this information on the downlow.

If you have decided to use the cash envelope system, do not divulge this information to anyone else. Let your family members keep this quiet too.

2. You’ll need to go to the Bank or ATM

Obviously, you’ll need to go in to the bank or ATM to access cash to add to your envelopes. This method requires you to go the the bank every time you need to replenish your stash. Once you’re organized, this may just be once a month though!

3. It might be difficult for Spouses who both make Purchases

When you have a spouse who also makes grocery runs, it can be difficult if only one person has the envelopes. In a case like this, the ‘food’ budget may need to be split into two so that both parties can have a ‘food’ envelope on his/her person at any given time.

4. It may be Difficult to get the Entire Family on Board

Any new habit may come with protests and reluctancy. Getting the entire family on board can be difficult if some members are totally against using cash and prefer to stick to using their cards.

5. You’ll Miss out on Rewards

Using cash means giving up credit card rewards such as cash back, points, miles etc.

Envelope Budgeting Apps to Help with the Cash Envelope System

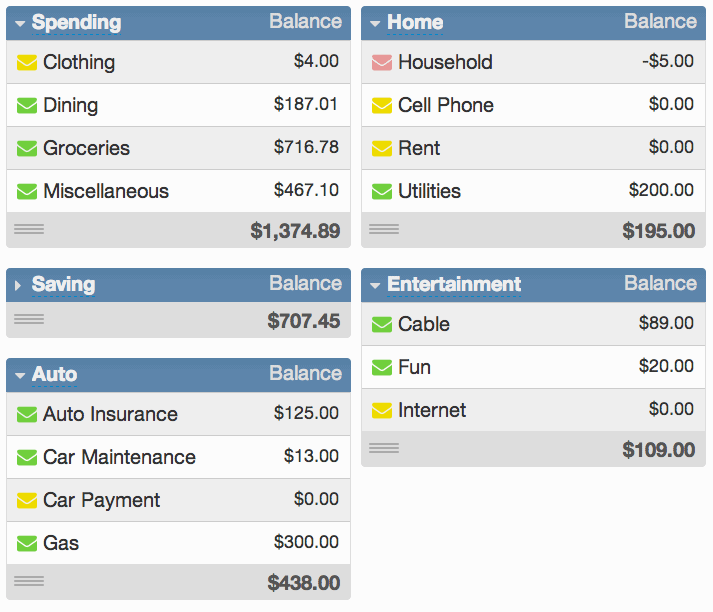

Now that you know a little more about the cash envelope system, wouldn’t it be awesome if you could get an envelope budgeting app that could help make the entire process easier?

You’ll be able to manage your cashflow and budget like a pro and it’ll be right at your fingertips. Not sure how much money is left in your fun money envelope? Don’t want to draw attention by digging through your pocket book and peeping into your envelopes? Not a problem – just open up your envelope budgeting app!

Want to analyse last month’s spending? Yup, use your app! Looking for certain trends in your spending? You guessed it – check your envelope budgeting app.

Your envelope budgeting app has got your back and it truly does make a very simple process even simpler.

4 Envelope Budgeting Apps that will Make the Cash Envelope System Super Simple

1. Mvelopes

Mvelopes is a budgeting app that makes the cash envelope system super easy. It takes personal finance to the next level by using ‘digital’ envelopes to help you with money management.

It provides a real time view of all your accounts so that you can start eliminating debt and gaining financial control.

2. GoodBudget

GoodBudget is a budget software ‘built for daily life.’ It also keeps you on track with your finances using the cash envelope system.

It helps with controlling spending and saving money and is ‘chock full of powerful features without compromising simplicity.’

3. Budget Ease

Budget Ease is yet another awesome, simple envelope budgeting software for your personal finances. It’s another digital envelope system which helps with taking control of your finances in a manageable way.

Their principles of budgeting are straightforward – don’t spend money you don’t have, plan ahead for expected expenses and build a cushion for the unexpected.

This app can execute a wide array of functions – all with a main goal of helping you take control of your finances. Aaron Freeman, the creator of Budget Ease stated, “Our goal is to make budgeting as easy as possible.”

4. MoneyWell

MoneyWell is another budgeting software built around the concept of the cash envelope system. It aims to keep you from overspending and to help you direct your extra cash towards debt reduction.

MoneyWell uses money ‘buckets’ and follows one simple rule – you should only spend what you have in your buckets.

There are many built in features to help you accomplish your goal of saving money, paying off debt and growing your wealth. It is a great tool for anyone with MAS and iOS.

Cash Envelope Template

Are you keen on using the cash envelope system? Want to get started right away? Look no further!

Here’s my free printable Cash Envelope Template (get immediate access!). All you need to do is download, print (I used different color sheets from an old scrap book that we had), follow the instructions to fold your envelopes and stick the edges together with glue.

The best part is that they’re absolutely free and can get you started with the cash budgeting system immediately! Feel free to decorate using fun items like markers, glitter pens, stickers and washi tape. Have fun with it!

Combined with one of the apps above, you’ll be well equipped for a successful cash envelope system!

DOWNLOAD THE CASH ENVELOPE TEMPLATE HERE

Frequently Asked Questions (FAQs) about the Cash Envelope System

At this point, I feel like I’ve probably covered everything you need to know about the cash envelope system. However, just to wrap things up (and add the nice big bow on top!) here are a few frequently asked questions – you know… some things that might still be causing some slight confusion for you.

I’ll try to answer them as clearly as possible. However, if you’re still confused about anything, feel free to shoot me an email or leave a comment below!

1. What if I make online payments?

Can you use the cash envelope system if you make online payments? Yes, of course you can!

You can still make your online payments and reserve your cash for everything else. By now, you would have learnt that this cash envelope system doesn’t HAVE to include paper envelopes.

You can absolutely ditch paper envelopes for one of the budgeting apps above (and conduct some of your transactions online) or you can also master a mix of online payments and cash-in-hand payments each month. Whatever you fancy!

2. What if I use debit cards for transactions?

Yes, you can still use the cash envelope system if you use debit cards for transactions. Just set up a good system to keep track of your spending.

You can use one of the budgeting apps or a simple budget printable (grab my FREE budget binder here) to keep track.

If you know you’re spending $200 on food for the month, write down every single transaction so that you never cross $200. It takes some extra discipline when you’re not dealing with actual cash but it can still be done!

3. What if I run out of money in my envelope?

The thing about the cash envelope system is that it requires discipline for it to work. This means that running out of money in any particular envelope shouldn’t be an option.

My suggestion is to have an extra envelope for emergencies with an allocated amount of cash in there. If you run out of money in your ‘Gas’ envelope, you can dig into your ‘Miscellaneous.’ However, you should always aim to stay on or under budget in all of your budget categories each month.

Other than this extra envelope, you must remember that it’s against the rules to borrow cash from another envelope to fund a category.

When you’re running low on cash in any particular envelope, get creative and find ways to stretch the remainder. Eat leftovers, do a pantry challenge, car pool, do a no spend challenge – anything that will help save money!

4. What if I have money left over in my envelope at the end of the month?

At the end of the month, any money that is left over can be used towards debt pay off or to grow your savings!

5. What happens if another family member makes grocery runs too?

If another family member makes grocery runs, pays bills etc. you can always create two envelopes for relevant categories. You can split the money 50/50 or 75/25 (use whatever ratios that work for you) depending on who does the shopping most often.

6. Can I still use this method if ALL my transactions are done online?

As mentioned above, you can absolutely rock the cash envelope system even if all of your transactions are done online. Just use one of the envelope budgeting apps (with digital envelopes) to track your spending and to stay in control of your finances!

Additional Tips and Information on the Cash Envelope System

The cash envelope system is one that can really help you get your financial life in order once used properly.

Ensure that:

- All categories (and by extension, envelopes) are included in your budget otherwise, you’ll encounter issues during the month.

- You have your envelopes with you at all times. You don’t want to end up in a situation where you need to pay for something and you don’t have cash. If you’re going to the grocery story and forgot your ‘food/groceries’ envelope, turn around and go get it!

- For added control, write down everything that you purchase. At the end of the month you’ll see exactly where every dollar has gone.

- If you know you overspend on gifts, makeup or any other hobby, set a budget and have an accountability partner. You must check in with them before and after any of these purchases.

- Create your budget, start prepping and fill up your envelopes on (or before) the first of each month.

All you need to do now is to get started! Taking control of your finances is just one step away. Imagine being able to live within your means. Yup, that’s what the cash envelope system can help you accomplish!

You can do it. Good Luck!

Related Budgeting Posts:

The Best Cash Envelope Wallets to Prevent Overspending (+Free Printable Templates)

A Complete Guide to Zero Based Budgeting

How to Create a Fail-Proof 50-30-20 Budget (+Examples, Spreadsheet & Free Printables)

Budgeting for Beginners – How to Create a Budget that Works in 7 Simple Steps

7 Best Budget Planners to Prevent Overspending and Save Money

Liked this post? Pin it!

Happy Saving, guys!

Until next time,

Leave a Reply