Table of Contents

Find a Free ATM for Cash App to Skip Withdrawal Fees

You’ve spent time building your Cash App stash and now you’re ready to cash out. You’re looking at your options, but nothing beats the feeling of trading out your virtual Cash App funds for real cash in hand!

Of course, there are a couple of ways to make this a reality, but one of the easiest ways is by using your Cash App Card at an ATM.

I love locating the closest Free Cash App ATM near me and using my Cash Card for an easy withdrawal! Even better, I love when there are no withdrawal fees! Let me explain how!

This post may contain affiliate links. This means that we may make a commission if you make a purchase via a qualifying link (at no extra cost to you!). You can read our full disclosure for more info.

Now in order to benefit from a Cash App ATM withdrawal, having a Cash Card is a must! The sign-up process for the Cash App Visa Cash Card is simple and free, and has 90347 advantages. So it’s a no-brainer really!

If you haven’t already, get started on your Cash Card application already. Using your Cash Card to make ATM withdrawals from your Cash App balance is just one of the benefits, but this alone is worth having it!

According to this article on Business of Apps, there are currently 44 million Cash App users, and over 13 million of them are Cash App Card holders!

But before we jump into how to use your Cash App Card to make ATM withdrawals and how to actually “find” a free ATM for Cash App (or how to avoid the fees anyway!), let’s take a look at the Cash App platform itself.

What is Cash App?

Cash App is a financial platform that provides an easy way to bank, invest, make payments, and send money to friends and family. It’s as simple as downloading the app (Use REFERRAL code: DKTGTCX for a FREE $5 Sign up BONUS), entering your basic info and choosing a cool Cash App name!

Cash App works like any other bank, allowing you to set up direct deposits to receive your paychecks. You can start investing and buying stocks with as little as $1! Cash App really does simplify your financial life by allowing all of these to be done from just one app!

Seriously, it is fast and free! You can even design a unique Visa Cash App debit card, which is linked to your Cash App account. This makes it even easier to make payments anywhere Visa cards are accepted, plus you can use it to withdraw cash from any ATM!

Everything to Know About Withdrawing Money from Cash App

Can you withdraw money from Cash App?

Yes, you can withdraw money from Cash App by either cashing out to your linked bank account, or by using your Cash App Cash Card at an ATM.

If your linked debit card for your bank account accepts instant deposit, you will be able to withdraw/transfer your money instantly from Cash App to your bank account.

However, if you want cash in hand immediately, you’ll then need to withdraw from your bank account via an ATM or by visiting your bank to withdraw the funds in-person.

If your linked debit card does not support instant deposit, unfortunately you will have to wait 2 – 3 days before the money from Cash App hits your bank account. Only then will you be able to withdraw the cash from your account!

If you want to withdraw money from Cash App immediately, using your Cash Card at an ATM might be the easiest and quickest option!

If you haven’t already signed up for a Cash Card, doing so may be worth it just to be able to enjoy this benefit! Ordering a Cash Card is totally free!

How to Withdraw Money from Cash App Card

The Cash Card is a Visa debit card that is linked to your Cash App balance. You can use it to make payments both online and in-store, but you can also use it to withdraw money from your Cash App account!

Withdrawing money from Cash App using your Cash App card is the same as with any other debit card.

Your Cash App account balance is like any other bank account. And your Cash App card works like every other bank card, when it comes to withdrawals!

You just need to visit the ATM, insert your card, follow the prompts, and receive your cash. That’s pretty much it! The Cash App card works at any ATM!

Info on Cash App ATM Withdrawals

Cash App Transaction Limits

Like any other bank, Cash App also has ATM withdrawal limits and debit card transaction limits. The transaction limits when using a Cash App Cash Card are $7 000 per transaction, $7 000 per day and $15 000 per month!

These limits include all conducted transactions – purchases using the card and ATM withdrawals! This means that the Cash Card cannot be used to pay for a single transaction that is higher than $7 000.

Also, if you are making several purchases throughout the day, they cannot amount to more than $7 000 in 24 hours, and this includes both ATM withdrawals and purchases with the Cash Card!

So for example, let’s say John has to make a big purchase tomorrow. He wants to buy a used car. The cost of the car is $7 500. He has more than this in his Cash App account.

However, he cannot use his Cash Card to conduct a Point of Sale transaction to cover the entire cost of the car.

He can pay $7 000, and use another method to pay the $500 difference. However, he cannot complete a $7 500 transaction with his card.

Similarly, if he makes a $6 500 purchase in any other store, on any given day, using his Cash Card, he’ll only have access to $500 of ATM cash withdrawals on that day. Total daily transactions cannot exceed $7 000!

Your Cash Card transactions are also limited to $15 000 per month.

The daily limit resets at 7:00 pm CT every night, the weekly limit resets at 7:00 pm CT every Saturday, and the monthly limit at 7:00 pm CT on the last day of every month.

Cash App ATM Withdrawal Limit

In additional to the overall transaction limits, Cash App also has specific ATM withdrawal limits! Even though you can use your Cash Card to complete a total of $7 000 in transactions for the day, only $1 000 of this can be an ATM withdrawal!

The ATM withdrawal limits when using a Cash Card are $1 000 per day, $1 000 per ATM transaction and $1 000 per week.

Note that, Cash Cards can also be used to get cashback at checkout when making purchases. But if you do take advantage of any cashback rewards, this counts towards your withdrawal limits!

For example, if you have already benefited from $100 cashback for this week, then you can only access a maximum of $900 through a Cash App ATM withdrawal for the remainder of the week!

How to Increase Cash App Withdrawal Limit

Currently, there is no way to increase the Cash App withdrawal limit. The ATM withdrawal limits remain as $1 000 per day, $1 000 per ATM transaction and $1 000 per week.

WANT TO MAKE SOME EXTRA CASH FROM YOUR PHONE IMMEDIATELY?

Join Swagbucks to complete surveys and do other simple online tasks to make extra cash and get free gift cards every month.

I make $1000+ from this!

Why wait? Join now to start making money!

Cash App ATM Fees

ATMs have different fees depending on the bank. When you use your Cash Card at an ATM you’ll have to pay these operator fees, as well as the Cash App fee of $2.00 – $2.50.

However, ATM withdrawals can be free for customers who receive at least $300 in paycheck / unemployment insurance deposits into their Cash App account, per month!

Even though you will be charged the Cash App ATM fee of $2.00 – $2.50, and the operator fees, Cash App will reimburse these fees for 3 ATM withdrawals per 31 days, and up to $7 in fees per withdrawal!

Remember that you’d have to have at least $300 in deposits per 31 days to benefit from this! Every time you receive at least $300 in deposits, your 31-day cycle is extended. Remember to activate your free ATM withdrawals, once the money hits your Cash App account!

Now, if you want to completely eliminate the ATM fees because you don’t meet the $300 deposit requirement, you can always transfer the money to your bank account, and use your bank debit card to withdraw the cash!

ATM Reimbursements

As mentioned above, Cash App makes ATM reimbursements to customers who receive at least $300 in paycheck / unemployment insurance deposits into their Cash App account, per month.

Once you satisfy this condition, Cash App will reimburse the $2.00 – $2.50 Cash App ATM fee, plus the operator fees, for 3 ATM withdrawals per 31 days, and up to $7 in fees per withdrawal.

This means that your first 3 ATM withdrawals for the 31-day cycle will be absolutely free! Any other ATM withdrawals completed in the 31-day period will cost you $2.00.

How to Get Money off Cash App at ATM

You can get money off Cash App at the ATM by using your Cash App Visa debit card (known as the Cash Card). It works just like any other debit card, and the withdrawal process is exactly the same!

How to Use Cash App Card at ATM

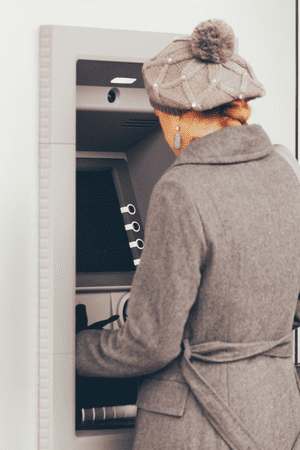

Using your Cash App Card at the ATM is super simple! The withdrawal process is the same as with any other bank account! As soon as you put in your card, the ATM machine will prompt you along the way!

Seriously, the entire process from start to finish will take about 1 – 2 minutes in total! But just in case you’re still uncertain, here’s a step-by-step breakdown of how to use your Cash App Card at the ATM.

Step 1: Put your Cash App Card into the ATM card slot.

Step 2: Wait for the ATM machine prompt for your pin number and enter it. Then press the button to confirm.

Step 3: The machine will ask you to enter how much money you want to withdraw. Enter this info and confirm.

Step 4: The ATM machine will start processing your request. You can now take back your card, the cash, and your receipt.

How simple was that?!

How to Get Money off Cash App without Card at ATM

Unfortunately, there is no way to get money off Cash App at the ATM without a card. Currently, Cash App does not have a cardless cash option.

For now, if you want to access your Cash App cash at the ATM, you’ll need to have your Cash Card!

Finding a Free Cash App ATM Near Me

What ATMs are free for Cash App?

Absolutely any ATM can be free for Cash App, for the first 3 transactions (per 31 days), if a customer receives at least $300 in paycheck / unemployment insurance deposits each month.

This is because Cash App reimburses all ATM fees (and up to $7 per withdrawal) for 3 ATM withdrawals per 31 days, once you satisfy the $300 deposit condition!

Any other ATM withdrawals completed in the 31-day period will cost you $2.00.

So if you truly want to benefit from free ATM withdrawals, stick to only 3 transactions per month. This will require some planning on your part.

For example, if you know you want to withdraw $300 this month, try to obtain this cash without going over your 3 free withdrawals!

Find a Free ATM for Cash App to Skip Withdrawal Fees (100+ Locations)

1. U.S. Bank

2. Fidelity

3. Lending Club Banking

4. Farmers National Bank

5. PNC Bank

6. Astra Bank

7. Bank of America

8. The First State Bank

9. Citizens State Bank

10. First National Bank

11. Golden Belt Bank

12. Sunflower Bank, National Association

13. Commerce Bank

14. Emprise Bank

15. Fifth Third Bank

16. First Green Bank

17. JP Morgan Chase Bank

18. Suntrust Bank

19. United Southern Bank

20. Wells Fargo Bank

21. First Republic Bank

22. Interbank

23. Ameris Bank

24. Colony Bank

25. Bank United, National Association

26. Iberia Bank

27. Commercial Bank & Trust Company

28. Connect Bank

29. First National State Bank

30. Capital One, National Association

31. First Bank and Trust

32. International Bank of Commerce

33. Grand Savings Bank

34. Security Bank and Trust Company

35. First Financial Bank

36. First Merchants Bank

37. LCNB National Bank

38. Old National Bank

39. The Farmers State Bank

40. The Twin Valley Bank

41. United Midwest Savings Bank

42. United Bank

43. American Savings Bank, FSB

44. First Hawaiian Bank

45. Hawaii National Bank

46. Territorial Savings Bank

47. NBH Bank

48. Pacific Premier Bank

49. Academy Bank

50. BOKF, National Association

51. Merchants Bank

52. Union Bank

53. MidSouth Bank (Florida & Alabama)

54. Peoples Community Bank (MO)

55. Bank of the West

56. Glacier Bank

57. Washington Federal (WaFd)

58. German American Bank (Indiana & Kentucky)

59. United Fidelity Bank

60. Availa Bank (Iowa)

61. First American Bank

62. Great Western Bank

63. The Bennington State Bank

64. First Bank

65. Peoples Bank and Trust

66. Simmons Bank

67. Sunflower Bank

68. Bangor Savings Bank

69. OceanFirst Bank (New Jersey)

70. Investors Bank (New Jersey, New York & Pennsylvania)

71. Valley Bank (Alabama, Florida, New Jersey & New York)

72. TD Bank

73. Santander Bank (formerly Sovereign Bank)

74. M & T Bank

75. Susquehanna Bank (Pennsylvania, Maryland, New Jersey, West Virginia)

76. Fulton Bank

77. Capital One

78. Truist Financial

79. Northwest Bank

80. Citibank

81. Sandy Spring Bank (Maryland)

82. Colony Bank

83. Pacific Premier Bank

84. Home Federal Bank

85. Liberty National Bank

86. Midwest Heritage Bank

87. Zions Bank

88. Big Horn Federal Bank (Wyoming)

89. Anchor Bank

90. Associated Bank

91. 7 – Eleven

92. Shaws

93. Hannaford

94. Safeway

95. Alta

96. E Z Mart

97. Gas Stations

98. Rite Aid

99. Publix

100. Walmart

101. Shoprite

102. CVS

103. Walgreens

Cash App ATM Locations Near Me (Zip Code Box)

To make it even easier to find your closest ATM, just enter your Zip Code and hit the button below. Having your virtual Cash App stash as actual cash in hand might be closer than you think!

Additional Info on Finding a Cash App Free ATM – FAQs

Which ATM does not charge a fee?

Many ATMs charge fees for non-customers. These fees vary depending on the bank. However, Cash App will reimburse these operator charges, plus their own $2.00 – $2.50 ATM transaction fee, for 3 ATM transactions per 31 days, and up to $7 in fees per withdrawal, if a customer receives at least $300 in paycheck / unemployment insurance deposits each month!

This means that you can have 3 Free Cash App ATM withdrawals, once you satisfy the Cash App deposit conditions.

What ATMs can I use for Cash App?

Your Cash App card can work at absolutely any ATM! This means that you can use your Cash Card to withdraw money from your Cash App account at any ATM.

Is there a free ATM for Cash App?

Any ATM can be free for Cash App if you qualify for the ATM fees reimbursement. You can get 3 free Cash App ATM withdrawals (per 31 days) if you receive at least $300 in paycheck / unemployment insurance deposited into your Cash App account each month!

What ATM is free for Cash App?

As a Cash App customer who receives at least $300 in paycheck / unemployment insurance deposited into your account per month, you’ll get to benefit from 3 free Cash App ATM withdrawals (per 31 days). These free withdrawals can be accessed at absolutely any ATM machine!

This is because technically you do pay the ATM fees up front, however you will receive reimbursement for the 3 Cash App withdrawals later.

Is Walgreens ATM free for Cash App?

As previously mentioned, a Cash App customer who receives at least $300 in paycheck / unemployment insurance deposited into his/her account per month gets 3 free Cash App ATM withdrawals (per 31 days). This is valid at any ATM, including a Walgreens ATM, since the fees are paid upfront during the transaction, and then later reimbursed by Cash App.

Is 711 ATM free for Cash App?

As previously mentioned, a Cash App customer who receives at least $300 in paycheck / unemployment insurance deposited into his/her account per month gets 3 free Cash App ATM withdrawals (per 31 days). This is valid at any ATM, including a 7-Eleven ATM, since the fees are paid upfront during the transaction, and then later reimbursed by Cash App.

Can I use my phone at ATM with Cash App?

No, you cannot use your phone at the ATM with Cash App to make withdrawals. Currently, Cash App does not support cardless cash. So, for now, if you want to make a cash withdrawal from your Cash App account, you will need to use your Cash Card!

Can you use Cash App card at ATM?

Yes, absolutely! You can use your Cash App card to withdraw money at any ATM!

Related Posts on Free Cash App ATM Near Me

17 Cash App Games that Pay Real Money

How to Get Free Money on Cash App Instantly

5 Legit Ways to Make Big Money with Cash App Flips

Final Thoughts on Finding a Free Cash App ATM Near Me

Utilize this list of Cash App ATM locations to skip the withdrawal fees and keep more money in your pocket! On a week-by-week basis, fees may seem insignificant, but they surely add up over time.

Now that you know how to take advantage of a free ATM for Cash App, you can save your dollars and put your money to better use! Trust me, every little bit counts!

Do you know of any other Cash App free ATM that is legit? Did we miss any Cash App ATM locations from our list above? Share with us in the comments below. We’d love to hear from you!

Don’t forget to follow us on Pinterest, Facebook and Instagram for more money-making tips, tricks and advice!

Liked this Post? Pin it!

Leave a Reply