This post is brought to you by Farther. All opinions expressed are my own.

It’s the start of the year and as customary, you may be thinking about your resolutions for the upcoming new year. If financial freedom is a goal of yours, then you may be wondering what you can do and what changes you can make to achieve this.

Maybe you’re not even sure where or how to start. Don’t worry. I’ve got the best financial resolutions for you to get your finances under control this year!

This post may contain affiliate links. You can read our full disclosure for more info.

Studies show that 80% of New Year’s Resolutions fail by February so whatever you do, you need to ensure that you set yourself up to stick to your goals.

Sometimes, this may mean seeking the help of an expert. And if paying down debt, having a healthy emergency fund set up, ending the paycheck to paycheck cycle, and being able to afford vacations and other luxuries sounds like a life you can get on board with, then you’ll definitely want to check out the experts at Farther.

If you really are serious about taking control of your finances once and for all, I’ll explain exactly how Farther can help you do this. But first, let’s talk about some of the financial resolutions you’ll want to set for the new year.

Once you have your goals set, we’ll talk about what you need to do to stick to them and about how you can use Farther to level up your financial game this year!

Table of Contents

10 Financial Resolutions that Will Change your Financial Life

1. Start a Budget and Stick to it

As cliché as this may sound, there’s no way you can achieve financial success by just winging it. Most successful ventures these days once started with a plan.

Seriously, if you want to take control of your finances once and for all, you’ll NEED to have a plan for your money. You’ll NEED to know exactly how much income you bring in each month, and exactly how much money needs to be spent on bills for you to survive.

Once you have this basic info figured out, you can then think about what you want to do with the extra (or if you need to get a second or third job to make ends meet at this point).

Remember that your decisions need to align with your goal of achieving financial freedom!

2. Increase Savings

What do you need to be saving for this upcoming year? Are you trying to save an emergency fund? A down-payment for a house? A vacation fund?

Whatever you’re trying to accomplish this year, saving money is always a great financial resolution to add to your list!

What I would advise though is to make it a specific and measurable goal. What does this mean? Well firstly it should be something that is actually attainable. You wouldn’t set a goal of saving $5000 this year when you just have $200 left over after paying bills each month, right? And measurable means setting a goal you can actually keep track of. Put a number amount to it. “I want to save $150 each month towards our bedroom renovation.” You know? Now every month, you can keep track of your progress. It’s something you can actually measure.

If you can’t think of anything to save towards right now, why not increase your emergency fund this year? Stay motivated with coloring pages and savings trackers to track your progress!

3. Pay down Debt

Another must-add to your list of financial resolutions should be paying down debt!

Think about that oh-so-happy day when you can finally do your debt-free scream. All the sacrifice that you’ll put in in the upcoming year as you work towards your debt-free life, will be so worth it in the end!

So what debt repayment goals should you set for the new year? Definitely pay more than the minimum!

Moving forward, you’ll need to decide on which debt pay-down method will work best for you — e.g. the debt avalanche method vs the debt snowball method. Both, once implemented right, will propel you towards a debt free life!

4. Adopt a Frugal Lifestyle

Adopting or maintaining a frugal lifestyle will go hand in hand with the other New Year Resolutions on this list. If you’re trying to pay down debt or save more money, a frugal lifestyle is a must!

What does frugal living mean anyway? Living frugally means saving money where you can and spending money on what adds value to your life. It means that you’ll have to live intentionally, saving money throughout the year so you can spend this extra on things that add value and joy to your life.

How can you live frugally? It’s a lifestyle actually! Changing little mindless habits that add up to save you huge bucks in the end. Little things like switching off the lights when leaving a room, drying your clothes on a line, or taking shorter showers can save you hundreds on electric bills.

You can purchase in bulk, use coupons or shop sales for things that you usually buy in your household. These little things result in big savings. Then you can use this money towards debt repayment, a luxury or your emergency fund. It all depends on your personal goals!

5. Increase Income

Let increasing your income be a financial resolution of yours this year! I can’t tell you enough how important it is to diversify your income!

According to The Balance, the economy lost a record 20.8 million jobs in April 2020 when businesses shut down. Personally, my family was also affected when my husband was sent home without his salary for a few weeks. But thankfully we had diversified our income and we were able to cover all over expenses (and more!) with our side hustle paycheck!

So think about how you can make extra income next year. Can you bake and decorate cakes like it’s nobody’s business? Why not start a small business from home and promote it on social media? Are you good at writing? Blog and website owners are always looking for content creators! You can make a pretty penny by being a freelance writer. You can make anywhere from $80 – $120 for a 1200 words article. Get started on a site like Fiverr to promote your services.

You can even explore options like working from home as a Transcriptionist or Proofreader. Or if you want to stick to simple real-life jobs, take a babysitting gig, offer lawn care services, find a second job, or push some extra hours at work.

6. Improve Credit Score

Achieving a good credit score is a long term process, but you gotta start somewhere, right? This year, let one of your resolutions be to work on improving your credit score. If you have plans to get a low mortgage interest rate, or even a credit card with good rewards, you’ll definitely need a good credit score!

Some actionable tips to improve your credit score this upcoming year include reducing your credit utilization ratio, fixing credit report errors and periodically using your dormant credit cards (to make purchases you need and already have cash in hand for anyway).

There are many more ways you can improve your credit score in a shorter timeframe. If you need expert help and advice in this area, do not forget that you can rely on the experts at Farther!

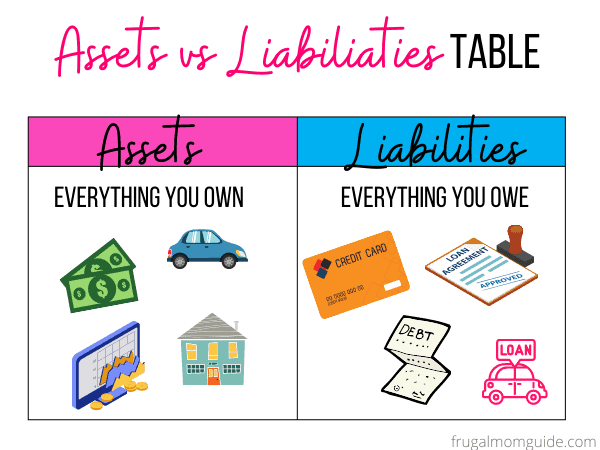

7. Increase Net Worth

Why not aim to increase your net worth this year?

Your net worth refers to what you own (your assets) vs what you owe (your liabilities). And yes, simply put, increasing your net worth means increasing what you own and decreasing what you owe.

If you’re working towards financial freedom, you’ll definitely want to work on increasing your net worth.

8. Stop Bad Financial Habits

Let one of your financial resolutions this year be to put an end to all of your poor money habits. Things like impulse buying, keeping up with the Joneses and losing track of your spending & budget should all be things of the past!

This new year, sit and analyze all your spending habits, your triggers and all the areas that can be improved. Then find solutions that can genuinely help.

9. Read more Personal Finance Books

Every year you should aim to improve your knowledge. And reading books is a great way to do this! This year, make it a goal to add some personal finance books to your reading list.

Some of my recommendations include The Total Money Makeover by Dave Ramsey and Rich Dad Poor Dad: What the Rich Teach Their Kids About Money That The Poor and Middle Class Do Not by Robert T. Kiyosaki!

10. Meal Plan

Meal Planning is a gamechanger and should make it onto every list of financial resolutions for the new year! If you meal plan each week and actually stick to it, you’ll find that you can save hundreds of dollars each month!

Set aside one day each week, preferably a Friday evening or Saturday morning, and plan all your breakfasts, lunches and dinners for the upcoming week. Ask your family to pitch in with ideas, and make a plan based on your schedule. For example, if the kids have dance classes or baseball practice on an evening, chances are you will not have the time nor energy to slave behind the stove. In this case, a crock pot dinner may be your best bet!

Also consider doubling recipes so that you can have leftovers for another day and simplify your life.

Once you come up with your meals, check out your pantry and make a list of the ingredients that you will need. Make one grocery run and grab everything on your list. Ensure that your meals and grocery list align with your budget.

You’ll need to stick to your budget and stick to your meal plan for this to work!

Sticking to your New Year Resolutions

You can make a whole list of New Year’s Resolutions and tuck them into a drawer and forget about them until December 31st rolls around again. Or you can make this the year that you fall into the 20% of resolutions that do not fail by February.

If you want to become debt-free, end the paycheck to paycheck cycle, have a healthy portion of income to save every month and enjoy luxuries without feeling guilty about spending, you’ll need to stick to those resolutions of yours!

To help you stick to your financial resolutions this year, here are some tips for you:

• Choose resolutions you actually WANT to achieve.

• Have a solid plan outlining exactly how you will follow-through with these resolutions.

• Learn your triggers that will tempt you to fall back to old habits.

• Replace old habits with new ones.

• Make sure you are setting SMART goals: Specific, Measurable, Achievable, Relevant & Time-bound

• Know when you need expert help and be willing to accept it.

Which brings me to my final point.

If you need help with your plumbing, you’ll call a plumber. And if you have an electrical issue, you’ll can an electrician. You’ll always call the expert for a solution that you can trust, right?

So why is it any different with your finances? Sometimes it’s absolutely worth it to call the professionals to help you avoid digging yourself any deeper!

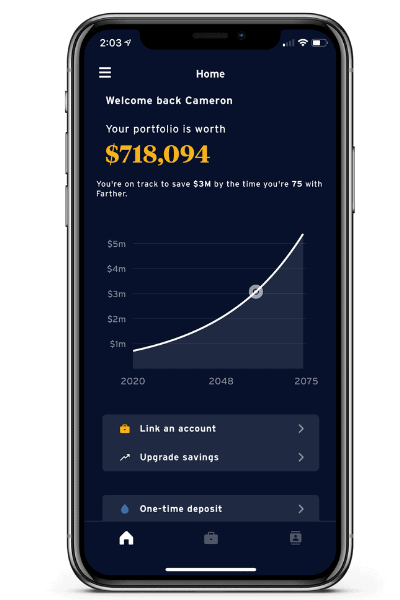

How Farther Can Help You Achieve Financial Success

And this is exactly what Farther can help you with. They pride themselves in being there for clients who dream of achieving a better future. They will help you make the most of your earnings so that you can finally build the dream home, start your business, set up retirement, or achieve the financial freedom to travel the world! They help take you money farther.

Their team of qualified financial experts will set you up on a path and build a solution to manage every aspect of your financial life so that you can finally say goodbye to debt and be on track to meet your financial goals.

What’s even better is that you can use their wealth management platform to start taking control of your money in under 10 minutes!

Farther has redefined the private bank experience allowing you to have access to something that was once reserved only for the world’s billionaires! Now you can have personalized financial advice for cash management and investment management success!

The technology does all the heavy lifting so that you can just sit back and not have to lift a finger. They will help you save money, optimize your returns and utilize tax advantaged accounts to reduce your tax liability.

It’s a no brainer, really. If you have any intentions of sticking to your financial resolutions and achieving financial freedom sooner rather than later, Farther is a pretty good place to start!

Related Posts on Financial New Year Resolutions

7 Best Budget Planners to Master Money Management This Year

How to Use the 50 30 20 Budget to Get Your Finances Under Control

10 Best Cash Envelope Wallets to Prevent Overspending This Year

Final Thoughts on Financial New Year Resolutions

Every year millions of people around the world set new year resolutions and forget about them just one week later. Chances are you may have fallen into this group of people quite a few times in the past.

If this is your year for financial freedom, choose which financial resolutions from this list align with your goals, and go for it. As you see the progress over the next few months, you will not regret it!

Do you have any other financial resolutions in mind? What are your long term and short term financial goals? Share with us in the comments below. We’d love to hear from you!

Don’t forget to follow us on Pinterest and Instagram for money-savvy inspiration throughout the year!

Liked this post? Pin it for later!

Leave a Reply