My husband and I have had our fair share of hard times. We’ve been together since college days and financially, we’ve had our ups and downs.

There was the time when he was laid off when I was around 3 months pregnant with our first child. At that time, I had a low income job. I was the only one working and we were expecting a baby. But guess what? We survived!

He got his current job around the same time that I gave birth and I transitioned to being a stay at home mom. I didn’t go out to work until recently when I got a job as a high school teacher.

It’s pretty safe to say that for the greater part of our marriage, we’ve survived on one income. To make this work, we’ve always been very careful about how we save money, saving and living frugally.

This post may contain some affiliate links. You can read our full disclosure for more info.

We got married at a relatively young age. We were both 22. Yet, we’ve always been financially responsible.

We have always invested and saved even when we were surviving on one low income.

One such time is when we needed to have $24 000 saved to be able to purchase the land that we wanted to build our house on. We had qualified for a mortgage but as a young couple, we needed to have 10% ($12000) saved to pay directly to the vendor and 10% ($12000) more in our savings account.

At that time, my hubby was the only one working so we were living on one income. But our frugal habits and side hustle expertise, helped us to save the money in no time!

Wondering what we did? Here’s our secret!

Table of Contents

9 Things We Did to Save $24 000 in 7 Months

1. Stopped Buying Unnecessary Products

This was the first step we took to start saving. When we looked at the things we were buying, we realized that some of them were a total waste of money!

For example, we were spending a fortune on bottled water when we could get it for free from the tap. We invested in a good water filter (we use this one) and we were good to go!

I also ditched paper towels, downgraded our cell phone plans and analyzed every single thing we were spending money on.

If they were unnecessary, they went out the window! Check out the full list of 29 Things We Stopped Buying to Save Money so you can start watching your savings account grow too!

2. Cut our Electric Bill in Half

This was another little change we made that resulted in huge savings. If you don’t practice energy efficient habits, you’re throwing away your money. Seriously. You might as well throw your dollars into the bin.

When I started making these little changes, our electric bill was cut by over 50%! We were now saving hundreds extra every month!

The thing is that most of these changes required little effort on my part. So why not give it a try?

Check out the 9 Little Changes that I Made to Cut our Electric Bill in Half. I wish I had known these tips and tricks sooner!

3. Cut our Grocery Bill in Half

Cut another bill in half? Yes please! Usually your grocery bill takes up one of the largest chunks of your budget. But by practicing these frugal habits, you can significantly lower your food bill for the month!

We also saved hundreds of dollars each month when we made a conscious decision to start saving on groceries!

Saving a few hundreds here and a few hundreds there really added up in the end.

Pssst! Did you know you can save more money by meal planning? Meal Planning saves me thousands of dollars every year! Not sure how to get started? Grab a copy of my free Meal Planning e-guide below.

4. Used Money Saving Apps

By now you’ve realized that every dollar counts. Every single dollar adds up in the end. And apps like Trim know this. When you’re trying to save a huge amount of money in a really short space of time, you’ll need all the help you can get! And if that help is free, it’s a no brainer in my opinion!

Trim is a free app that helps solve your financial problems so that you can live the life you want. It helps by automatically handling your day to day finances, seeing to it that you’re never wasting money on late fees or unnecessary subscriptions, you’re not being overcharged by your service providers (it does the negotiating for you!) and you’re paying off debt and saving money for emergencies and retirement.

Trim boasts of saving their users over $40 million… Imagine if some of this was in your savings account too! Well it can! 🙂

While we’re on money saving apps, Tally is an app that you must check out if you need help paying off your credit cards faster!

Let’s face it. If you’re trying to save a huge amount of money in a short space of time, debt can really hinder your progress. But you can absolutely find a way to make both work together by paying off and saving at the same time.

Here’s where Tally comes in. Tally helps you pay off debt faster. If you want to save money on interest and pay off your Credit Cards faster, see if you qualify for help from Tally.

5. Budgeted (and Stuck to it)

Ah. Budgeting. Just simply having a budget can help you save so much money each month! I cringe at the thought of how much money I wasted in my pre-budgeting days. One day we’d collect our paycheck, pay the bills and the rest was history. To this day, I can’t tell you where half of our money went.

Luckily, this phase didn’t last long at all. It was mostly when we had collected our first few decent paychecks. The good old money & immaturity combo was in effect… SIGH.

We soon wisened up and started budgeting so we could know exactly how and where each dollar (and cent!) was being spent. The result? Hundreds of dollars in savings each month!

6. Had a few No-Spend Months

Many of the 7 months over which we saved were actually no-spend months.

What is a no-spend month? Well just as the name suggests, a no-spend month (or any no spend challenge really) is a set period of time where you choose to spend no money. The only money that you spend is usually on necessities like food and bills.

This doesn’t mean that we just sit around being bored during our no spend challenges. Here are some of the fun things that we did during our no spend challenges that were absolutely FREE!

7. Used a Money Saving Challenge

We kept things fun and interesting by following a money saving challenge. You can choose a weekly, monthly or annual challenge based on your situation and circumstances.

I always choose to follow a money saving challenge in addition to budgeting, following frugal habits etc. It just gives the extra OOMPH to help you save a little bit more. And of course every little bit extra counts in the end!

At the time, I followed a money saving challenge based on our one income and the money we were getting then.

This year, we’re on yet another challenge to save (at least) $15 000 (in 6 months). To accomplish this goal, I am currently following Money Challenge #6 on this list of Best Money Saving Challenges to Crush your Financial Goals this year.

However, I am doubling up the amounts to save each week. This, combined with all the other tips on this post, will surely help us save quickly again. This time, we’re going to start building our dream home on the land that we bought! 🙂

If you want to follow this journey, you can opt in to our newsletter here! I’d love to take you along with me and share everything that I’m learning along the way. 🙂

8. Side Hustled to Make Extra Money

Side Hustling is a major part of our saving strategy. There’s no way we could save so much on our bare incomes.

At that time, my side hustle was blogging. Believe it or not, you can make a full time income from blogging! Of course it requires a lot of work up front but it’s an amazing way to make passive income eventually.

I wasn’t making a full time income back then BUT whatever extra I earned did help us save more! Think blogging might be something for you? Check out my step-by-step guide on how to get started.

All extra money earned was added to our savings account. Blogging wasn’t our only side hustle! In fact, my husband and I have been no strangers to side hustling so all this extra money really added up in the end. Side hustling even paid for our wedding rings! Check out this list of side hustles that has made us tons of money in the past!

Another side hustle that we usually do (it’s actually a form of passive income) is buy and sell stock. We invested in stock and sold it when the price went up. This also contributed to our large savings in a short space of time.

9. Used Rakuten

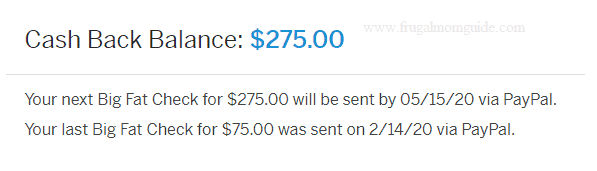

For all the necessities that we needed to buy, we used Rakuten! Rakuten gives you cash back and even has some double cash back stores! Basically, if you’re going to shop on Amazon (or literally any other store on the internet – most of them are listed), log in to your Rakuten account and shop from there.

It’s really one of the easiest ways to make money these days. Look at an actual screenshot of cash back that I received!

Where did my cash back go? In my savings account of course! Hello! $24K in 7 months! Clearly you can see that every dollar adds up!

Want to earn cash back too?

Sign up for Rakuten here and get $10 free when you first start shopping through them!

Now, I must warn you to stick to the things that you NEED to buy. Remember that you are trying to save. And we all know that the internet can be a rabbit hole. So you are using Rakuten to purchase just your necessities! Mmkay? Good!

Related Reads:

How to Make a Budget Plan for Beginners – A Simple 7 Step Guide

A Complete Guide to Zero-Based Budgeting

25 Fail-Proof Frugal Living Tips to Drastically Reduce your Household Expenses

How to Get Amazon Freebies Shipped Straight to your Door

So, you want to save money fast?

Anyone can save money fast! Yes, including you!

It takes a change in mindset, positive thinking and a whole lot of discipline to save large amounts of money. So tighten that belt, and let’s get started!

***To get started, I’m giving you access to my FREE 5 Days Money Management Course. This will help you prepare, plan and organize your finances so that you can build up your savings and get rid of debt too! Just enter your email and you will get the course delivered straight to your email inbox!***

So are you ready to do this? Let’s GO!

Don’t forget to share and pin for later! While you’re there, I’d love for you to follow me on Pinterest!

Until next time,

HEY! PIN ME FOR LATER!

Great Ideas! Trying to cut out fees also helped us. We were wasting money paying fees we could have easily avoided, like monthly bank account fees, or late fees on bills which we paid a day or two late.

We used the opposite strategy to the “no spend months”. My Wife and I had an allowance each month that we could spend on whatever we liked, guilt free. This way we didn’t feel like we were missing out while budgeting.

Thanks Joe!

Recently we’ve added an ‘allowance’ category in our budget too! Sometimes you need to change things up a bit.

I’m also an Ebates fan! Currently, I’m trying to cut my grocery bill to help me save up faster for a cash car. It’s taking a ton of discipline but I know saving fast can be done.

Hey Dyana!

That’s awesome! Every dollar really does add up in the end. Cutting the grocery bill, electric bill and all other household expenses translate to hundreds of dollars each month!

Good luck on your journey. Keep it up and you’ll be car shopping in no time! 🙂